RoboForex

The Unvarnished Truth About RoboForex: An In-Depth Review from a Seasoned

Let’s be real. The world of online trading is a minefield. One wrong step, one misplaced trust, and your capital can vanish into thin air. I’ve been navigating these waters for over a decade, and I’ve seen brokers come and go. Today, I’m putting RoboForex under the microscope. You’ve probably seen their ads, maybe even been tempted by their RoboForex affiliate program. But the question echoing in every prudent trader’s mind is the same: Is RoboForex safe? This isn’t just another regurgitated list of features from their website. This is my RoboForex honest review, built on careful analysis, community feedback, and a critical look at the facts that truly matter – like regulation and user experience. We’re going to cut through the marketing fluff and get to the heart of whether this broker is a worthy partner or a RoboForex scam.

First Impressions: A Sleek Facade and Promises of Prosperity

My first visit to the RoboForex website was, I’ll admit, impressive. The site is modern, slick, and packed with information. They present themselves as a global, all-in-one financial hub. It’s easy to get swept up in the promise of sophisticated platforms like MetaTrader and cTrader, and the allure of their various partnership opportunities.

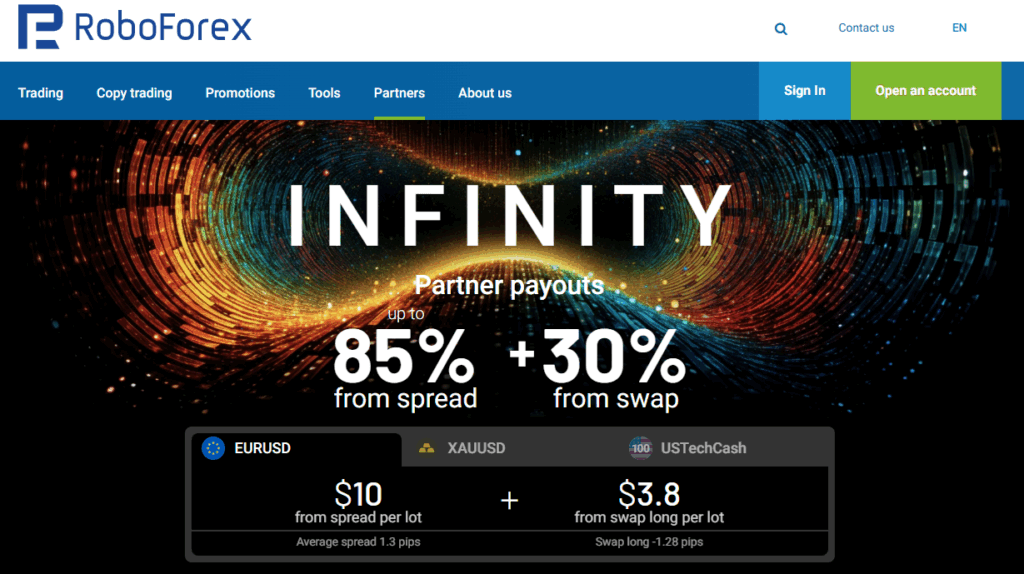

I dug into their RoboForex partnership program, and on the surface, it looks lucrative. They offer multiple models: the RoboForex IB program (Introducing Broker), RoboForex CPA (Cost Per Acquisition), and RoboForex RevShare (Revenue Share). The promise of a generous RoboForex partner commission is a powerful magnet for those looking to earn money online. Who wouldn’t be tempted by the idea of generating passive income through a simple RoboForex referral link? But here’s the cold, hard truth I’ve learned: a beautiful website and attractive affiliate terms mean very little if the foundational elements of trust and security are missing. The real test begins when you look beyond the marketing.

Is RoboForex Regulated?

This is the single most critical question you must ask about any broker. So, is RoboForex regulated? The answer is complex and, for many, deeply concerning.

RoboForex operates primarily through an entity registered in Belize, regulated by the International Financial Services Commission (IFSC). Let’s be blunt: Belize is an offshore jurisdiction known for its relaxed regulatory environment and minimal oversight. While this might be legally permissible, it offers retail traders like you and me significantly less protection than a broker regulated by top-tier authorities like the UK’s FCA, Australia’s ASIC, or Cyprus’s CySEC.

What does this mean for you?

- Lower Capital Requirements: Offshore regulators don’t require brokers to hold as much capital, which can be a risk if the company faces financial trouble.

- Weaker Client Fund Segregation: The rules for keeping your money separate from the company’s operating funds are often less stringent.

- Limited Recourse: If you have a dispute, your options for legal recourse are much more limited and expensive compared to dealing with a European or Australian-regulated firm.

- No Investor Compensation Schemes: You are not protected by compensation funds (like the £85,000 FSCS in the UK) that can cover your losses if the broker goes bankrupt.

For me, this is the biggest red flag. A broker’s regulatory status is the cornerstone of its credibility. When I see a broker targeting international clients from an offshore base, it immediately raises questions about their long-term commitment to client safety.

A Closer Look at the RoboForex Partnership Program: Too Good to Be True?

All about the RoboForex affiliate program

Many are drawn to RoboForex not to trade, but to participate in their RoboForex affiliate program. The idea is simple: you refer clients, you earn money. As an RoboForex introducing broker, you can potentially build a steady income stream.

However, after scouring forums and talking to other affiliates, a pattern of RoboForex complaints emerges. The issues often aren’t with the initial sign-up or the tracking of referrals, but with the sustainability of the model. The most common grievance I found is intrinsically linked to the broker’s reputation. If the traders you refer start experiencing RoboForex withdrawal problems or feel the RoboForex trading experience is unfair, they will leave. Your RoboForex partner commission depends on active and happy traders. If the core trading service is plagued with issues, the affiliate model crumbles. I read one story from a former affiliate who built a substantial network, only to see it disintegrate because his referrals consistently faced unexpected fees and difficult withdrawal processes. His RoboForex RevShare income plummeted. This highlights a critical point: a partnership program is only as strong as the underlying service.

The RoboForex Review Trading Experience and Payouts

- Spread Widening: While spreads can be tight on some accounts, there are complaints about them widening unexpectedly.

- Platform Stability: Occasional platform freezes and requotes have been noted, which is every trader’s nightmare.

But the most damning feedback consistently revolves around RoboForex deposit and withdrawal. The deposit process is typically smooth and instant – they are happy to take your money. The real problems begin when you want it back. RoboForex withdrawal problems are a dominant theme in online forums. Users report:

- Lengthy Processing Times: Withdrawals that should take a few days can drag on for weeks.

- Onerous Verification: Being asked for excessive documentation repeatedly, even after initial account verification.

- Unjustified Fees: Hidden or unexpected fees that eat into profits.

- Unresponsive Support: A runaround from customer service when questioning delays.

When a broker makes it difficult to access your own funds, it’s the ultimate red flag. Your capital is your livelihood; any obstacle to retrieving it is unacceptable.

RoboForex Review Pros and Cons

Let’s break it down clearly. Here are the RoboForex pros and cons based on my research:

Pros:

- Wide variety of trading platforms and instruments.

- Multiple account types to suit different trading styles.

- Extensive educational and analytical resources.

- The affiliate program can be attractive on paper.

Cons:

- Offshore regulation with weak client protection.

- Widespread complaints about withdrawal delays and processes.

- Questions about trade execution quality during volatile periods.

- The affiliate model is undermined by the broker’s own reputational issues.

For me, the cons, particularly the regulatory status and withdrawal complaints, heavily outweigh the pros. The potential risks to your capital are simply too high.

RoboForex Review Scam or Legit?

After this deep dive, we return to the fundamental question: RoboForex review scam or legit?

I would not classify RoboForex as a straightforward “scam” in the sense of a fake website that disappears with your deposit. They are a legitimate company that has been operating for years. However, the combination of offshore regulation, a high volume of serious user complaints, and persistent issues with fund withdrawals places them firmly in the “high-risk” category.

The RoboForex honest review from someone who prioritizes security is this: there are far safer, more transparent, and better-regulated alternatives in the market. Why take a chance with an offshore broker when you can choose one that is regulated by a top-tier authority and has a sterling reputation for client service and easy withdrawals? Your money and your financial future are too important to gamble with. The allure of a high RoboForex partner commission or tight spreads is not worth the potential nightmare of not being able to access your funds when you need them. Do your own due diligence, read the RoboForex real reviews from past and current users, and make a choice that prioritizes safety above all else.

Please sign in to your account to leave a review.